Graduation is here! That means it’s time for students to move – and lots of new renters will be entering the market.

Graduation is here! That means it’s time for students to move – and lots of new renters will be entering the market.

But while their graduation shows they’ve learned a lot, a recent survey proves most people know very little about Renters insurance.

For example, six of 10 U.S. adults who rent a house or apartment don’t have renter’s insurance, and of those uninsured:

- 57% think they don’t need it because their apartment has decent security,

- 48% believe their landlord’s insurance will cover their belongings, and

- 21% assumed it would cost $1,000 or more each year.

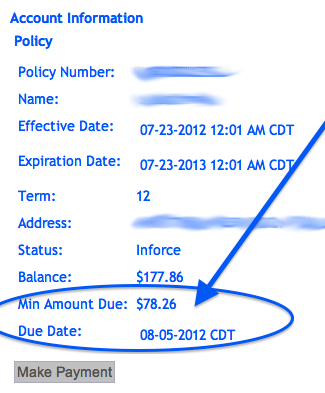

Agents can make the difference here. Educate your clients on the availability, need and affordability of Renters insurance. With policies averaging under $200 per year and coverage options like:

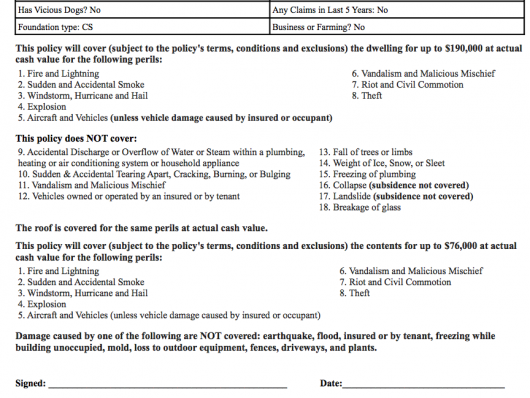

- Replacement Cost on Contents,

- Contents Coverage Limits up to $50,000,

- Liability Coverage Limits up to $300,000,

- Medical Payments Limits up to $2,000, and

- Theft Coverage

There really is no reason for your clients to be caught unprotected.

(The telephone survey of 1,004 adults was conducted by Princeton Survey Research Associates International from Feb. 7-10, 2013.)