Today we remember that the price of freedom is high. For some it costs everything.

Texas Homeowners Dwelling MobileHome Renters Vacant Insurance

Texas Personal Property Homeowners, Dwelling, MobileHome, Renters and Vacant insurance solutions for independent agents for hard to place risks.

At iMGA we have much to be thankful for, and we’re especially thankful for our agents. Here are some of the reasons why insurance buyers should be grateful for a good independent insurance agent:

So we encourage everyone to join us in thanking our insurance agent for being there for us when we need them. They are great to have in our corner and we’re glad they are!

If you’re an independent insurance agent in Texas who would like to find out more, please fill in the form to learn more about becoming an iMGA agent.

The passage of time dulls the senses, so it’s almost impossible to truly recall the shock and horror of that day and the unified sense of purpose of the time immediately following the worst attack on U.S. soil in our country’s history.

The passage of time dulls the senses, so it’s almost impossible to truly recall the shock and horror of that day and the unified sense of purpose of the time immediately following the worst attack on U.S. soil in our country’s history.

The attack was carried out via four jetliners hijacked by 19 members of al-Qaeda. One was crashed into the Pentagon. Brave passengers prevented another Washington D.C. target from being hit by overpowering the hijackers on their plane over Pennsylvania. Two were flown into the twin towers of the World Trade Center in New York City.

Two thousand, nine hundred and seventy-seven (2,977) people from 70 countries became innocent victims that day, including every passenger and crew member on all four airliners. Many of us personally knew at least one of the victims.

Two thousand, nine hundred and seventy-seven (2,977) people from 70 countries became innocent victims that day, including every passenger and crew member on all four airliners. Many of us personally knew at least one of the victims.

The impact on our country – from airports to border crossings – has been widespread and enduring. Whole new federal agencies have been created and law enforcement powers have been expanded.

Most critical, though, is that we – each American citizen – remember. Remember what we’ve suffered, but also what we’ve overcome. Through the diligence and hard work of the American people the United  States has recovered, and then some. Our economy and our country are strong and will grow stronger, because of our people, as long as we are diligent and continue to have confidence in each other and our way of life.

States has recovered, and then some. Our economy and our country are strong and will grow stronger, because of our people, as long as we are diligent and continue to have confidence in each other and our way of life.

The best response we can have now is to do just that – live out the American dream, and let our success speak for itself.

One of the best things about iMGA’s Flood Program is how many of your insureds are eligible for the coverage! The iMGA Flood Program is not limited to dwellings insured with iMGA.

We are able to offer much higher limits in the Flood program – higher than either the NFIP program or our Dwelling and Homeowners programs:

NFIP’s maximum Coverage A is $250,000, and contents are limited to $100,000.

NFIP only provides coverage for detached garages up to 10% of Coverage A – and it reduces the limits available under Coverage A. The 10% available in our program is an additional limit to Coverage A.

Our program also provides up to 5% of Coverage A for trees, shrubs, and plants coverage, and $500 for any fire department charges that the insured may incur during a flood event. NFIP provides $0 for either of those.

Our additional living expense are payable in the event that civil authority prevents access to the property whether or not the insured property is damaged by the flood event. Lost rental income is also covered for rental properties involved in a flood event. Again, NFIP does not cover either.

Also, iMGA’s flood program has a maximum waiting period of 7 days, much better the 30-day waiting period for the NFIP program.

This program is very easy to quote and issue in a matter of minutes. Once you input the address, there are only 12 basic questions to answer, and we will return multiple coverage options with various deductibles from a single request.

We do not need an elevation certificate, which is a huge cost saving benefit for the insured. Since it is based on the actual physical address, and not some Army Corps of Engineers flood map zones, the actual elevation of the property is used from very detailed topographical mapping. So, even if a risk is located in a high flood zone, the rates will vary house to house from the single rate used by the NFIP for that flood zone.

Finally, for insureds who already purchase flood insurance, there is no waiting period. We can issue a policy effective the same day as their NFIP, or other, flood insurance expires!!!

This program is written through Lloyds’ of London which is A. M. Best Rated “A”. Like our other products, payment plans are available with up to 9 payments. Of course, as we do with all of our other products, agents are able to add an agency fee directly to the policy which will be payable both on new AND renewal business which is fully disclosed to the insured and further shows on the declarations page.

This program is available statewide. So, please log into our system and quote your clients’ flood coverage.

Remember, in the flooding that hit the New Braunfels, San Marcos, Wimberley, and Houston areas, fewer than 50% of the flooded homeowners carried flood insurance. The same was true in the 2017 floods in Louisiana. This was not only a tragic situation, but one that lead to many E&O cases for agents. Along those lines, we have provided for a signature line for the insured to sign rejecting the flood coverage quote which can be saved in your files.

We have made the quoting process as simple fast and painless as possible, so give our Flood program a try.

For additional details, please see the Flood Quick Reference guides posted on our website. Or, feel free to call us here at iMGA and speak with either Ishie or Matt at extensions 12 or 13 respectively.

We hope to be your go-to Flood market, and are always happy to help you with any questions on any of our products.

‘Twas the week before Christmas, and Texas, thank God,

Had made it through hail and wind and flood.

Our claims were all settled and roofs well-repaired

And insureds were thrilled that their agents were there.

With Vacant and Renters and Homes of all types,

Clients knew they had coverage wherever they abide.

Coverage for pets and mold and foundations

Gave even more reason for their joyful celebrations.

From Muleshoe and Alpine, to Freer and Llano,

In Waco and Midland, to Boerne and Conroe,

From North to South to East to West,

There is no doubt our agents are best.

So we work to provide service that is second to none,

With clear communications mixed with some fun,

And we gladly exclaim as Christmas draws near,

“Merry Christmas to all, and to all a great year!”

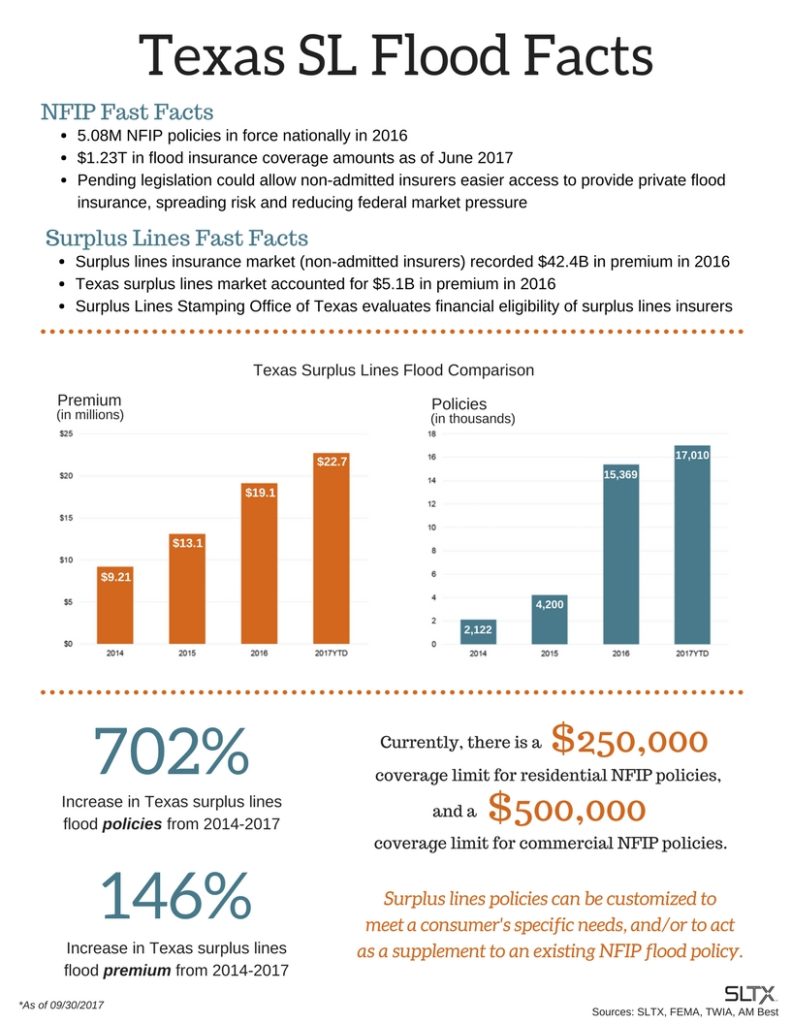

In 2016 Non-Admitted carriers accounted for over $5.1 billion in premium in Texas. Private flood insurance was only $19.1 million of that.

But as the federal government has begun the process of opening the flood insurance market to private competition, the coverage options have increased and the number of people choosing these new private options has increased dramatically.

As a result, the number of Non-Admitted flood policies has increased 702% just between 2014 and so far in 2017. The state office that regulates Surplus Lines (Non-Admitted) policies in Texas just released a statement saying:

“Proposed bills in Congress could allow easier entry into the flood market by private surplus lines insurers, spreading risk and reducing building pressure on the NFIP. The surplus lines market has proven that if this legislation passes, it is ready and able to take on an increased market share.”

That same department (the Surplus Lines Stamping Office of Texas) produced this infographic to show just how much and how quickly things have changed for the better for Texas consumers:

The iMGA flood program, and other Non-Admitted programs, can offer higher coverage limits, shorter wait times, better payment plans, improved coverages and more. If you’re a Texas independent insurance agent that represents iMGA, quote one today or call our underwriting department for details. If you’re a Texas independent insurance agent that does not represent iMGA, start that process now.

We’ve seen first hand in Texas how devastating floods can be. As an agent you know how important it is for your clients – even ones whose neighborhoods haven’t flooded in decades – to have good flood coverage.

We’ve seen first hand in Texas how devastating floods can be. As an agent you know how important it is for your clients – even ones whose neighborhoods haven’t flooded in decades – to have good flood coverage.

Just as important, we’ve seen insureds without flood coverage sue their agents claiming that they were never presented with a Flood coverage quote – making for a big E&O exposure and claim.

iMGA is proud to provide you access to one of the best flood products on the market – one with dwelling limits up to $1 million, plus contents, other structures and loss of use coverage up to a total insured value of $2 million, a wide range of deductible choices, easy payment options and a 1 week or less waiting period.

But the best possible policy isn’t of any use if you can’t present the quote – and it won’t protect you if it isn’t presented.

So at iMGA we’ve now made it so on every iMGA Homeowners quote you can also get a Flood quote with almost zero extra effort. Simply review five extra questions and that’s it – you’ll get a Flood quote too! If your insured rejects that Flood coverage our system gives you a very clear rejection option that you can have them sign – protecting you in the case it turns out later they needed that coverage.

At iMGA we work very hard to make things as easy and useful for our agents as possible. If you’re an iMGA Texas independent insurance agent, quote a homeowners policy today. If not, start the process to become an agent.

Disclaimer: Is not currently available in the following counties:

Aransas, Bee, Brazoria, Brooks, Calhoun, Cameron, Chambers, Fort Bend, Galveston, Goliad, Hardin, Harris, Hidalgo, Jackson, Jasper, Jefferson, Jim Wells, Kenedy, Kleberg, Liberty, Live Oak, Matagorda, Montgomery, Newton, Nueces, Orange, Polk, Refugio, San Jacinto, San Patricio, Tyler, Victoria, Waller, Wharton, Willacy

Hurricane Irma has just ravaged the Virgin Islands and caused significant damage in Puerto Rico and Florida as well. Closer to home we’ve just begun the hard work of recovering from Hurricane Harvey’s damage in Texas.

Hurricane Irma has just ravaged the Virgin Islands and caused significant damage in Puerto Rico and Florida as well. Closer to home we’ve just begun the hard work of recovering from Hurricane Harvey’s damage in Texas.

On this particular date – 9/11 – we think not only of those current events, but also of the clear September morning when it felt like the world changed forever.

There’s an amazing video recap of the news as it unfolded. One that should help more people remember and share the shock, the horror, and the chaotic confusion of the day.

We remember the irreplaceable losses:

While we continue to remember those losses, we also remember the resolve, the spirit of cooperation and the outpouring of support that followed. We see that same spirit at work in relief and recovery efforts in and around Texas today. We see the same already happening with the Virgin Islands, and it undoubtedly will in Puerto Rico and Florida also.

Please take a moment today to remember and pray for the fallen victims and heroes from 9/11/2001 and the loved ones they left behind.

Please also do what you can to support those freshly hurting.

Together we can – and do – make a difference. That’s something very good to remember.

In the legislative session that ended in May 2017, the Texas Legislature passed HB 1774, which finally prevented abusive lawsuits that dramatically increased the cost of home insurance for all Texans. Unscrupulous people are taking advantage of the devastation caused by Hurricane Harvey in Texas to spread false stories about what HB 1774 did and did not change.

In the legislative session that ended in May 2017, the Texas Legislature passed HB 1774, which finally prevented abusive lawsuits that dramatically increased the cost of home insurance for all Texans. Unscrupulous people are taking advantage of the devastation caused by Hurricane Harvey in Texas to spread false stories about what HB 1774 did and did not change.

Fortunately the organization Texans for Lawsuit Reform has released a solid factual statement with the truth, the short answer of which is a resounding NO!:

Statement Regarding Hurricane Harvey and HB 1774

AUSTIN – Texans for Lawsuit Reform today issued the following statement regarding Hurricane Harvey:

“TLR was founded in Houston and continues to have strong roots in the community. We are devastated to see the damage that has been unleashed on the city, and on our friends, family and neighbors,” TLR President Dick Trabulsi said. “The Texans affected by this historic disaster deserve our full support as they begin to pick up the pieces. To assist with disaster relief efforts across the impacted area, TLR has made a donation to the American Red Cross, and we ask all Texans to join us supporting the relief efforts and in praying for all who have been impacted.”

As with any evolving situation of this nature, misinformation can spread quickly. Texans should have the facts about insurance claims following Hurricane Harvey:

The normal insurance claims process has not changed. Reform legislation passed in the last legislative session (HB 1774) goes into effect on September 1, 2017, and applies to lawsuitsfiled after that date. A person making a claim with her insurance company after September 1, 2017 will go through the same process as a person making a claim before September 1, 2017. Texans should contact their insurance companies directly to file claims.

Lawsuits are the exception – not the rule, and the vast majority of Texans will resolve their claims without needing to file a lawsuit.

Beware of anyone—lawyer, adjuster, contractor, or anyone else—claiming to help you get more money from your insurance company.

If your insurer does improperly deny or delay paying your claim, Texas has the strongest consumer protections in the nation for you, which will continue to be the case after September 1, 2017. Texans can receive full damages for unpaid claims, can recover attorney fees for legal action taken to recover those damages, and can also recover penalty interest. If an insurer acts fraudulently or in bad faith, additional remedies, including the recovery of triple damages, are available to Texans. This is true today, and it will be true after the reform legislation HB 1774 goes into effect on September 1, 2017.

The primary purpose of the new statute is to require written notice of a dispute before a lawsuit is filed. If a lawsuit is filed, it would happen months or years after the initial claim was made with the insurance company. Nothing in the new law passed by the Legislature earlier this year requires that the initial insurance claim be made in writing or by a specific date.

• The requirement for a written pre-lawsuit notice (not pre-claim notice) to the insurance company ensures the company is aware of its policyholder’s complaint and has had an opportunity to adequately address that complaint before being sued. It is a part of existing Texas law and does not disadvantage policyholders.

Furthermore, the new law will not apply to most claims or lawsuits arising from Harvey, because most of the policyholders’ claims will be for damage caused by flooding. These claims will be made under the federal flood insurance program and governed by federal law.

Similarly, the new law will not apply to lawsuits pursued against the Texas Windstorm Insurance Association (TWIA), which is subject to an entirely different statute governing post-disaster lawsuits. TWIA provides insurance for many people affected by Harvey in our coastal counties.

The law that will become effective on September 1, 2017, is designed to do two important things:

1. Discourage the feeding frenzy by lawyers and contractors following natural events occurring in Texas over the past several years. These unscrupulous actors have taken advantage of thousands of hard-working Texans over the past several years.

2. Encourage out-of-state insurance adjusters to come work in Texas following a massive disaster like Harvey. In the following days and weeks, it will be critically important for out-of-state adjusters to work in Texas to ensure that insurance claims are evaluated and paid in a timely manner.

In sum, the new law does not affect the claims process. Instead, it affects only the lawsuits that sometimes follow the claims process. Furthermore, it does not create a new deadline for action by policyholders.

Texas and Mexico have a long history together, from Spanish colonies in both places in the late 1600s, through the Texas Revolutionary War against Mexico, to the current $41 billion per year in Texas exports to Mexico.

Texas and Mexico have a long history together, from Spanish colonies in both places in the late 1600s, through the Texas Revolutionary War against Mexico, to the current $41 billion per year in Texas exports to Mexico.

So it’s no surprise that in Texas any major “celebration of Mexican heritage and pride” is celebrated widely.

It may be a surprise to you, though, that while Cinco de Mayo, the 5th of May, commemorates the victory of the Mexican militia over the French army at The Battle of Puebla in 1862, it’s NOT Mexico’s Independence Day, which is September 16. Given the long and rich history Texas and Mexico share, though, it probably should not be surprising that the victorious commander of The Battle of Puebla, Gen. Ignacio Zaragoza, was born in Goliad in 1829.

Cinco de Mayo is primarily a regional holiday celebrated only in the city and state of Puebla, and “is a holiday that is virtually ignored in Mexico”.

The Battle of Puebla was a relatively insignificant event. The French forces were beaten back, but they did capture Puebla only a year later. It’s not even a national holiday in Mexico. Yet on this day each year millions of people, of Mexican heritage and not, will celebrate the day in the United States.

What has caught fire with your clients? Are you trying different ideas? The only way to know what will work is to test many options. When one does catch fire – run with it! Next thing you know you may have a surprise holiday of your own.

What has surprised you? What has resonated with your clients that you didn’t really expect? Share your experience in the comments.