Many iMGA customers have taken advantage of the ability to sign up for auto check payment of their insurance premium.

Many iMGA customers have taken advantage of the ability to sign up for auto check payment of their insurance premium.

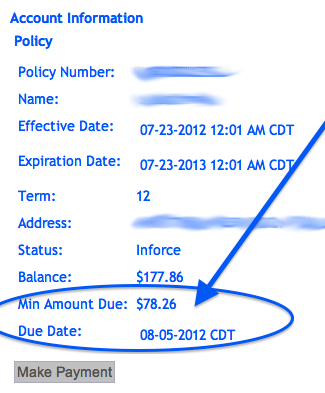

When they do that they are much less likely to ever miss a payment or incur a late fee. Plus they don’t have to worry about mailing a bill or going online.

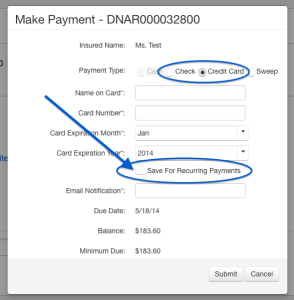

Well now iMGA clients who prefer to pay by credit card can take advantage of the same benefits.

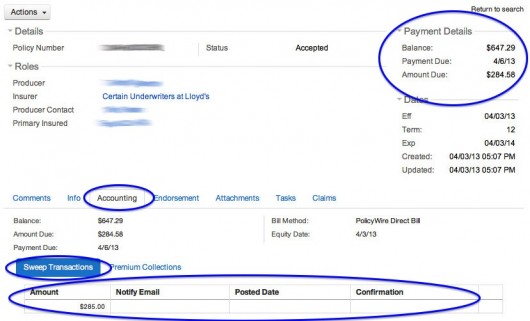

That’s right – we now offer automatic recurring credit card payments! Simply pay your client’s invoice with their credit card as normal, then click on the box to “Save for Recurring Payments” and the minimum due will be paid on the due date automatically. They’ll still get a reminder notice each month with the amount we’ll apply to their card and the date we’ll process the transaction.

And of course they’re free at any time to discontinue the automatic payments or change their AutoPay account if they change their mind.

If you’re a Texas insurance agent who would like to offer personal property products from a company focused on making things as easy as possible, start the process here.