Sometimes it would just help a lot if a bill were only due a week or two earlier – or a few days later – every month.

Sometimes it would just help a lot if a bill were only due a week or two earlier – or a few days later – every month.

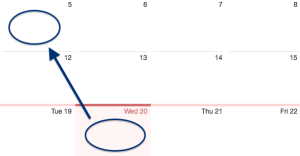

Now iMGA customers can change their due date if doing so would help.

The woman on a fixed income who would really like her bill due on the 25th, the couple on social security who like to pay all their bills by the 7th, the family who would prefer to arrange this new bill to come just after the paychecks they get on the 15th – all of those insureds can have their preferences met.

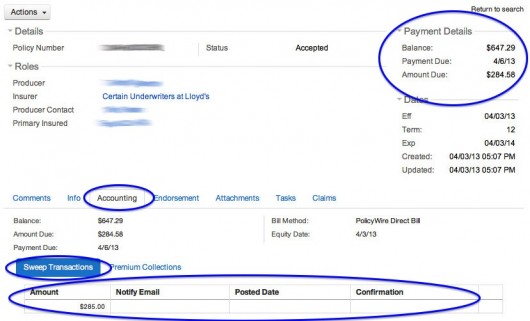

Just call and let us know what date you would prefer. If you want to move the date up (make it earlier), just tell us. If you want to move it back a small payment may be needed to cover the additional premium for the days included in the change. Either way we can take care of it quickly and easily.

Custom payment dates – just one more way iMGA is working to make insurance easier for our agents and their clients.