We’ve seen first hand in Texas how devastating floods can be. As an agent you know how important it is for your clients – even ones whose neighborhoods haven’t flooded in decades – to have good flood coverage.

We’ve seen first hand in Texas how devastating floods can be. As an agent you know how important it is for your clients – even ones whose neighborhoods haven’t flooded in decades – to have good flood coverage.

Just as important, we’ve seen insureds without flood coverage sue their agents claiming that they were never presented with a Flood coverage quote – making for a big E&O exposure and claim.

iMGA is proud to provide you access to one of the best flood products on the market – one with dwelling limits up to $1 million, plus contents, other structures and loss of use coverage up to a total insured value of $2 million, a wide range of deductible choices, easy payment options and a 1 week or less waiting period.

But the best possible policy isn’t of any use if you can’t present the quote – and it won’t protect you if it isn’t presented.

So at iMGA we’ve now made it so on every iMGA Homeowners quote you can also get a Flood quote with almost zero extra effort. Simply review five extra questions and that’s it – you’ll get a Flood quote too! If your insured rejects that Flood coverage our system gives you a very clear rejection option that you can have them sign – protecting you in the case it turns out later they needed that coverage.

At iMGA we work very hard to make things as easy and useful for our agents as possible. If you’re an iMGA Texas independent insurance agent, quote a homeowners policy today. If not, start the process to become an agent.

Disclaimer: Is not currently available in the following counties:

Aransas, Bee, Brazoria, Brooks, Calhoun, Cameron, Chambers, Fort Bend, Galveston, Goliad, Hardin, Harris, Hidalgo, Jackson, Jasper, Jefferson, Jim Wells, Kenedy, Kleberg, Liberty, Live Oak, Matagorda, Montgomery, Newton, Nueces, Orange, Polk, Refugio, San Jacinto, San Patricio, Tyler, Victoria, Waller, Wharton, Willacy

St. Patrick’s Day – also known as the Feast of St. Patrick – celebrates and commemorates the life of the patron saint of Ireland.

St. Patrick’s Day – also known as the Feast of St. Patrick – celebrates and commemorates the life of the patron saint of Ireland.

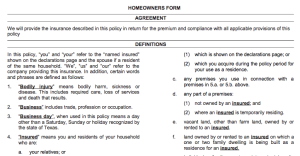

Thankfully, though, the iMGA Texas Elite Homeowners policy automatically includes coverages many insureds wouldn’t think to request but sometimes really need, like*:

Thankfully, though, the iMGA Texas Elite Homeowners policy automatically includes coverages many insureds wouldn’t think to request but sometimes really need, like*: