At iMGA we work very hard to make things as easy as possible for our agents and customers. We know our agents work with many companies and many products and it can be hard to be sure you let the customer know what is and is not covered on their policy.

We think we have part of the solution. While we still do not require signed applications for our policies, we now have applications available for you to provide to your customers. As of today, those applications for our Texas Elite HOA/HOA+/HOB and Admitted HOA/HOA+ Homeowners products automatically display the covered perils for the dwelling and contents along with limits and whether the coverage is at replacement cost or actual cash value.

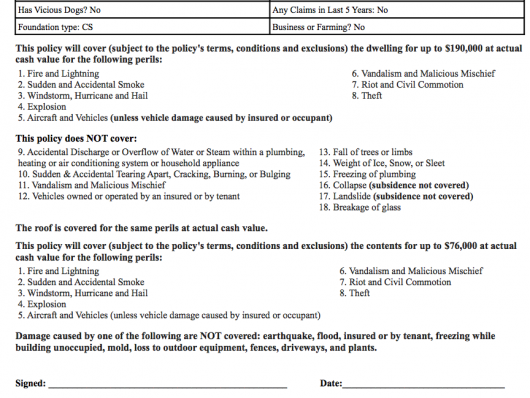

Here’s a shot of what that looked like for a sample base HOA policy without replacement cost coverage:

We hope this makes your life simpler, and makes it much easier for you to ensure your customers understand their coverage.

If you’re an agent who doesn’t work with us already and you’d like to work with a market devoted to making Texas MobileHome, Homeowners, Dwelling, Vacant and Umbrella as easy as possible, please tell us about yourself.