The most common reason for cancelled policies is simply failure to pay. For every policy cancelled you have to sign up another new customer just to stay even, and growing your insurance agency becomes much harder.

Even if you’re able to win the client back, you – and they – will face unnecessary costs and difficulties in dealing with cancellations and reinstatements.

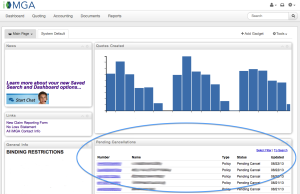

All of that can be avoided if you help your clients keep the insurance they already have. At iMGA we’ve made that much easier to do. When you log in the list of policies in Pending Cancellation status will automatically show, with the most recently modified policy at the top of the list:

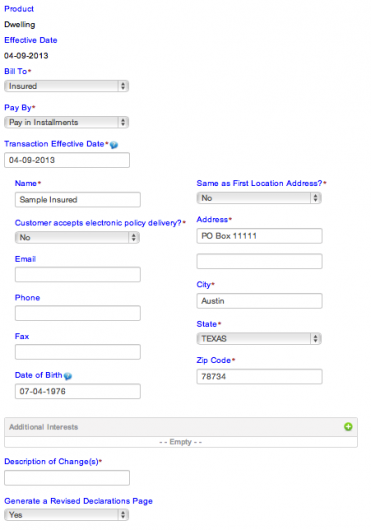

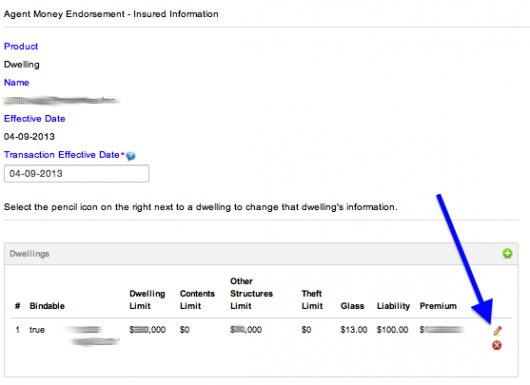

To review the details of any of the policies displayed just click on the policy number shown.

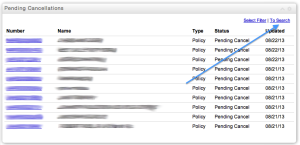

To see the full list of all your Pending Cancellation policies, simply click on the “To Search” link:

You can then call or email the clients who are at risk for canceling their policies and avoid unnecessary problems. Your clients will thank you and your agency growth will increase – truly a win-win.

At iMGA we work hard to make things as easy as possible for all our independent insurance agents. If you’re a Texas agent who sells homeowners, dwelling, renters, vacant and mobile home policies, please contact us about becoming an iMGA agent.