When Henry Ford launched the Model T he famously said, “Any customer can have a car painted any colour that he wants so long as it is black.”

When Henry Ford launched the Model T he famously said, “Any customer can have a car painted any colour that he wants so long as it is black.”

These days none of us – including our customers – accept such a limitation. Fortunately, when it comes to property insurance, you don’t have to try to shoehorn your customers into a narrow range of options.

iMGA Texas Personal Property Means Options

Form Options

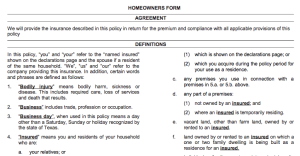

On iMGA Homeowners and Dwelling policies you have the opportunity to offer the widest possible range of form options – from an HOA or TDP1 basic named-perils policy with Actual Cash Value coverage to the HOB or TDP3 broad-form open-perils policy with Replacement Cost coverage.

But your options don’t stop there.

Coverage Options

Once you’ve selected the Form, you can still tailor the options. With iMGA – unlike most companies – you’re not forced to buy 20% loss of use coverage – or limited to only that amount, and the same goes for Contents and Other Structures coverages. On each of these coverages you can either offer your customer the opportunity to reduce the cost of their policy or to increase their coverage to properly protect their specific risk.

Coverage Types

In addition to Forms and Coverage limits, you can also offer coverage type variations. If a roof is too old you can still cover the dwelling with Replacement Cost while offering Actual Cash Value coverage on the roof. If the roof is too old or doesn’t qualify for some other reason, you can still cover the dwelling and have the roof coverage limited to Fire and Lightning Only.

On iMGA Renters policies you can decide whether to offer Replacement Cost on contents or not.

Optional Coverages

In addition to the Form and Coverage type options, there are also additional coverages you can offer your iMGA clients, such as scheduled guns, business personal property, business liability, theft coverage on Renters policies, and much more.

So fortunately you don’t have to limit yourself – or your clients – to just one option. You can truly tailor their coverage to exactly what they need. At iMGA we’re proud to be able to help.

If you’re a Texas independent insurance agent who’d like to be able to offer more options on personal property insurance, please tell us more about yourself.