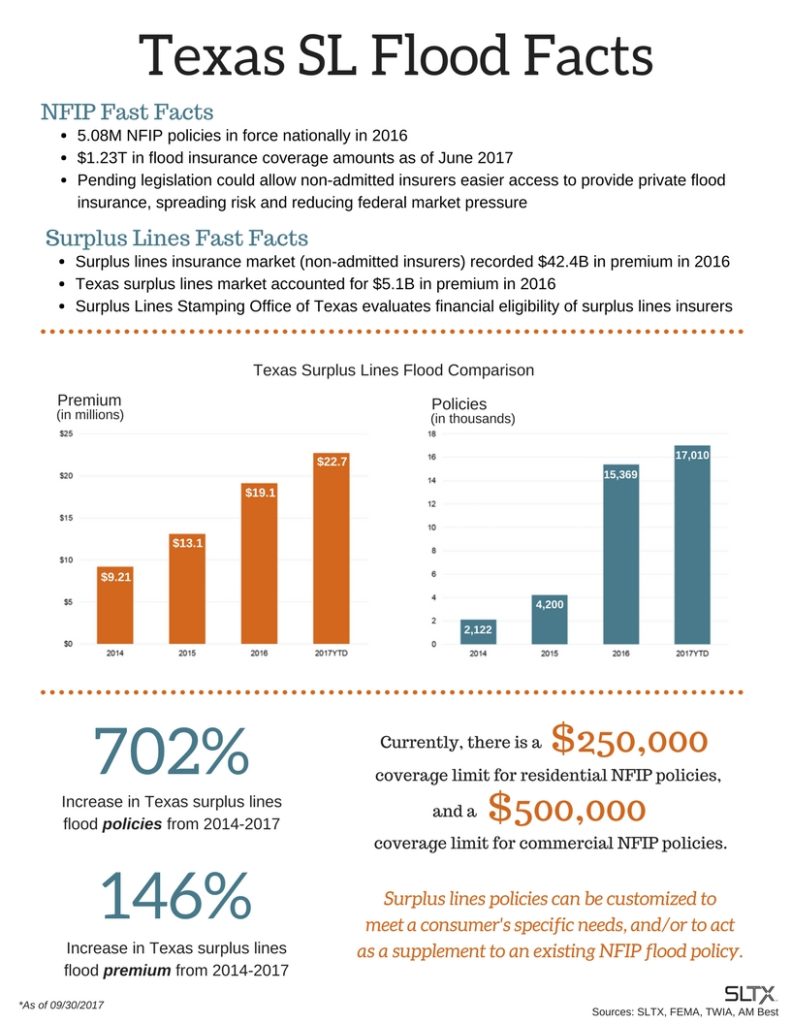

In 2016 Non-Admitted carriers accounted for over $5.1 billion in premium in Texas. Private flood insurance was only $19.1 million of that.

But as the federal government has begun the process of opening the flood insurance market to private competition, the coverage options have increased and the number of people choosing these new private options has increased dramatically.

As a result, the number of Non-Admitted flood policies has increased 702% just between 2014 and so far in 2017. The state office that regulates Surplus Lines (Non-Admitted) policies in Texas just released a statement saying:

“Proposed bills in Congress could allow easier entry into the flood market by private surplus lines insurers, spreading risk and reducing building pressure on the NFIP. The surplus lines market has proven that if this legislation passes, it is ready and able to take on an increased market share.”

That same department (the Surplus Lines Stamping Office of Texas) produced this infographic to show just how much and how quickly things have changed for the better for Texas consumers:

The iMGA flood program, and other Non-Admitted programs, can offer higher coverage limits, shorter wait times, better payment plans, improved coverages and more. If you’re a Texas independent insurance agent that represents iMGA, quote one today or call our underwriting department for details. If you’re a Texas independent insurance agent that does not represent iMGA, start that process now.