One of the best things about iMGA’s Flood Program is how many of your insureds are eligible for the coverage! The iMGA Flood Program is not limited to dwellings insured with iMGA.

We are able to offer much higher limits in the Flood program – higher than either the NFIP program or our Dwelling and Homeowners programs:

- Coverage A limits up to $1,000,000,

- Optional contents coverage up to $500,000,

- Optional other structures up to $100,000, and

- Optional additional living expenses up $200,000.

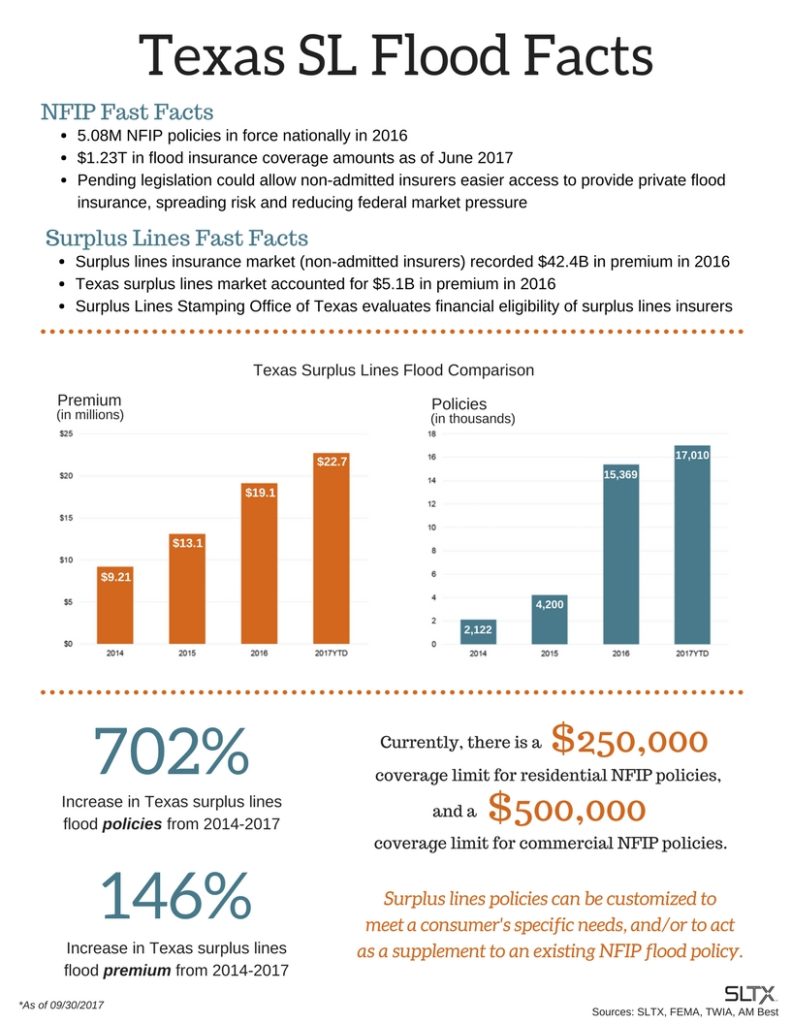

NFIP’s maximum Coverage A is $250,000, and contents are limited to $100,000.

NFIP only provides coverage for detached garages up to 10% of Coverage A – and it reduces the limits available under Coverage A. The 10% available in our program is an additional limit to Coverage A.

Our program also provides up to 5% of Coverage A for trees, shrubs, and plants coverage, and $500 for any fire department charges that the insured may incur during a flood event. NFIP provides $0 for either of those.

Our additional living expense are payable in the event that civil authority prevents access to the property whether or not the insured property is damaged by the flood event. Lost rental income is also covered for rental properties involved in a flood event. Again, NFIP does not cover either.

Also, iMGA’s flood program has a maximum waiting period of 7 days, much better the 30-day waiting period for the NFIP program.

This program is very easy to quote and issue in a matter of minutes. Once you input the address, there are only 12 basic questions to answer, and we will return multiple coverage options with various deductibles from a single request.

We do not need an elevation certificate, which is a huge cost saving benefit for the insured. Since it is based on the actual physical address, and not some Army Corps of Engineers flood map zones, the actual elevation of the property is used from very detailed topographical mapping. So, even if a risk is located in a high flood zone, the rates will vary house to house from the single rate used by the NFIP for that flood zone.

Finally, for insureds who already purchase flood insurance, there is no waiting period. We can issue a policy effective the same day as their NFIP, or other, flood insurance expires!!!

This program is written through Lloyds’ of London which is A. M. Best Rated “A”. Like our other products, payment plans are available with up to 9 payments. Of course, as we do with all of our other products, agents are able to add an agency fee directly to the policy which will be payable both on new AND renewal business which is fully disclosed to the insured and further shows on the declarations page.

This program is available statewide. So, please log into our system and quote your clients’ flood coverage.

Remember, in the flooding that hit the New Braunfels, San Marcos, Wimberley, and Houston areas, fewer than 50% of the flooded homeowners carried flood insurance. The same was true in the 2017 floods in Louisiana. This was not only a tragic situation, but one that lead to many E&O cases for agents. Along those lines, we have provided for a signature line for the insured to sign rejecting the flood coverage quote which can be saved in your files.

We have made the quoting process as simple fast and painless as possible, so give our Flood program a try.

For additional details, please see the Flood Quick Reference guides posted on our website. Or, feel free to call us here at iMGA and speak with either Ishie or Matt at extensions 12 or 13 respectively.

We hope to be your go-to Flood market, and are always happy to help you with any questions on any of our products.