What to Cover

What to Cover

Every client coming to you for homeowners insurance is aware of the need to cover their primary dwelling. But only good questioning by you will reveal the other things that they have that need coverage as well.

Fortunately iMGA systems guide you through the questions on some of those other things that might need special coverage, including:

- Other Structures (outbuildings, storage sheds, etc.)

- Business Personal Property

- Computers

- Scheduled Personal Property (engagement rings, jewelry and collectibles)

- Farm and Ranch Equipment

How Much Coverage to Buy

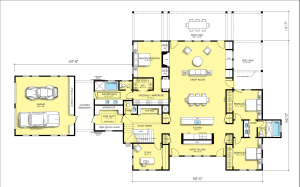

Far too many people buy the amount of homeowners insurance needed to pay off their mortgage. But critical provisions of homeowners policies require that clients purchase the amount of insurance necessary to replace the home. That means the right amount of insurance could easily be much more or less than the mortgage.

Fortunately, iMGA systems include a replacement cost calculator to help make sure that the coverage amount chosen when the policy is issued is within the needed range. Of course like any other tool it is highly dependent on what you input and the information that your insured has given you.

For example:

- If there is an attached garage, those quote questions need to be answered correctly.

- If the insured has finished out the garage as living space or done some other major addition then the square footage needs to be increased.

- Also, the build quality can swing the valuation a large amount in either direction.

So make sure that you ask your insureds detailed questions about their property so that this critical decision can be made properly.

When to Update Coverage

According to AccuQuote.com, replacement costs have risen an average of 7% per year. That means the replacement cost of the average home has more than doubled in the last 11 years, and has a very high likelihood of being underinsured after only a few years.

If that’s not enough, homeowners frequently upgrade – remodel, put in a pool or addition, or make other changes that increase the value and replacement cost of the home.

Clients depend on you, their trusted advisor, to ensure these coverage decisions are made in an informed manner. At iMGA we work to make doing so as easy as possible for you.

If you’re a Texas insurance agent who would like to work with a company focused on helping make your job easier, let us know.