Compound interest is an amazing thing. One penny, doubled every day, produces almost $11 million dollars after just 30 days. Unfortunately it’s hard to get anyone to pay you 100% return each day on your money. : )

What you absolutely can do, though, is invest in your agency and put the miracle of compounding to work in your favor.

If you just make one small change in your agency each week and it only results in one half of one percent improvement, that translates to almost a 30% improvement over a year, and almost a 70% improvement over two years.

We live this at iMGA every week. Sure, we introduce new products a lot more often than most markets, but we can’t introduce a new product every week. There is a lot we can do, though, and big or small we make sure we do something every week. Here are just a few from the last year:

- New payment plans

- Lower down payments

- Higher limits

- Increased capacity

- Improved systems speed

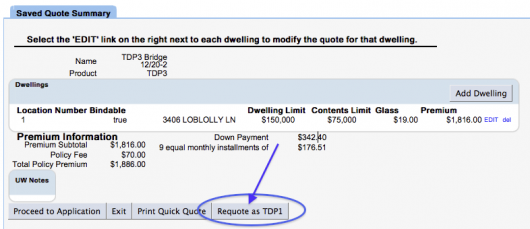

- Improved quote and application workflow

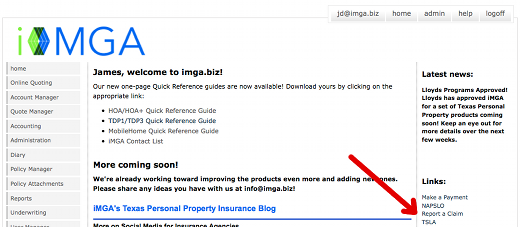

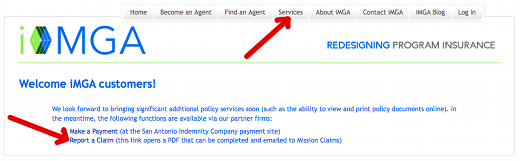

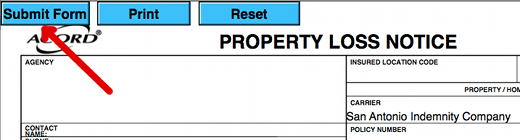

- Automatic follow-up communications

- An easier-to-understand bill

This week our major system upgrade is a change is bigger than most. What’s most important about it, though, is that it prepares the way for many more changes over the next year. You’ll immediately notice the new wider policy detail display that makes it easier to read, especially on smaller monitors. You may also notice that we’re now able to assign multiple CSRs/Agents to a particular policy in case you want multiple staff members notified about changes.

Much more important than what you will notice this week, though, is that this upgrade will let us slowly, consistently, inexorably, add one more morsel of communication or remove one more just-slightly-annoying step each and every week. We are giddy at the thought, and hope that you are consistently surprised and delighted by the changes.

Are you doing the same in your agency? Is there someone responsible for working on your business efficiencies each week?

Turn your agency into a perpetual improvement machine. Just .5% per week makes a 70% difference in only two years – and wouldn’t you like to see that in your commission reports?