These days it’s more important than ever to be sure your customers are insured with solid markets that will be there for you – and them – for the long run.

That’s why at iMGA we’re so proud to provide products backed by solid, stable carriers.

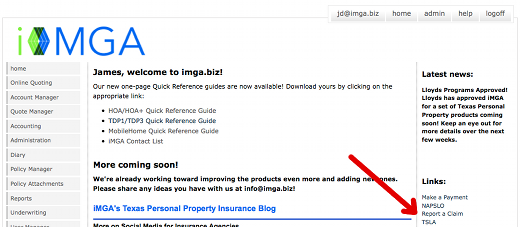

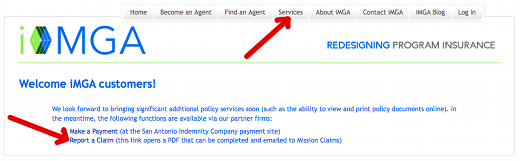

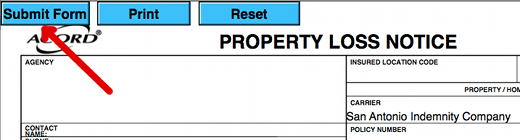

The iMGA admitted programs are all underwritten by San Antonio Indemnity Company, an A.M. Best B++ rated carrier that has been doing business in Texas personal property for over 30 years. A.M. Best affirmed SAIC’s rating – and stable outlook – just 45 days ago. Plus, all the programs are backed by well-respected A rated reinsurers.

The iMGA Non-Admitted Homeowners program is backed by Ace and Catlin, two of Lloyds of London’s leading syndicates, both of which are A rated.

So, whether it’s helping provide you with a market for your new MobileHome, TDP1, TDP3, HOA, Non-Admitted Homeowners, or Vacant dwelling customers, or helping you move an entire book, iMGA and our carriers are here for you.